Shield Wall Media and METALCON conducted an industry survey that generated a lot of information, and we are providing a few of the basics here. Watch for our new Construction Survey Insights —Annual (a stand-alone magazine mailing in April) for more in-depth construction industry insights.

You wouldn’t begin a build without previewing the project, considering what will be needed and any foreseeable obstacles, then making a plan. Starting a new year of business requires the same precaution.

Let’s begin our preview by seeing what industry economists have to say.

Economists Have Their Say

Economist Anirban Basu regularly reviews the state of the economy and its likely impact on the construction industry. He has provided a mixed outlook for 2024.

“The upcoming year will present varied challenges and opportunities for contractors,” Basu said. “… those working on residential properties will likely see a shore up of projects due to a tough real estate market.” In other words, with high real estate prices and lower supply than demand, residential construction isn’t likely to slow down. Further, Basu sees growth opportunities in mega-projects across the country as many manufacturers reshore supply chains. These projects will call for more employees in an industry that already offers more job opportunities than skilled/quality workers to take them.

When considering what situations may negatively affect peoples’ plans to build, Basu advises remembering these: high consumer debt, geopolitical uncertainty, stricter credit conditions, and the government’s increasing debt. However, he believes that the bond market indicates a likely decline in interest rates by mid year. If this occurs, it could mean greater project financing and backlog generation.

Ken Simonson, Chief Economist of the Associated General Contractors of America, said that after a torrid third quarter in 2023, slower growth is expected going into 2024. Overall, he believes that unemployment will remain low.

Simonson said. “Employers in expanding industries such as construction, will continue to have trouble filling positions, and will have steadily increasing wage bills for new workers (when they can find them) and overtime or bonuses.”

While most supply chain issues have been cleared up, Simonson added that there remain a few holdouts, such as electrical equipment, and it looks like these will likely remain problems throughout 2024. He expects these supply challenges along with labor shortages will stretch project completion times.

Specific niches that Simonson expects to do well in 2024 include renewable energy projects.

According to the Survey

While no one is really sure of what lies ahead, a lot depends on people’s perceptions and confidence in the market. One sign of true confidence is to be found in a company’s plans to expand.

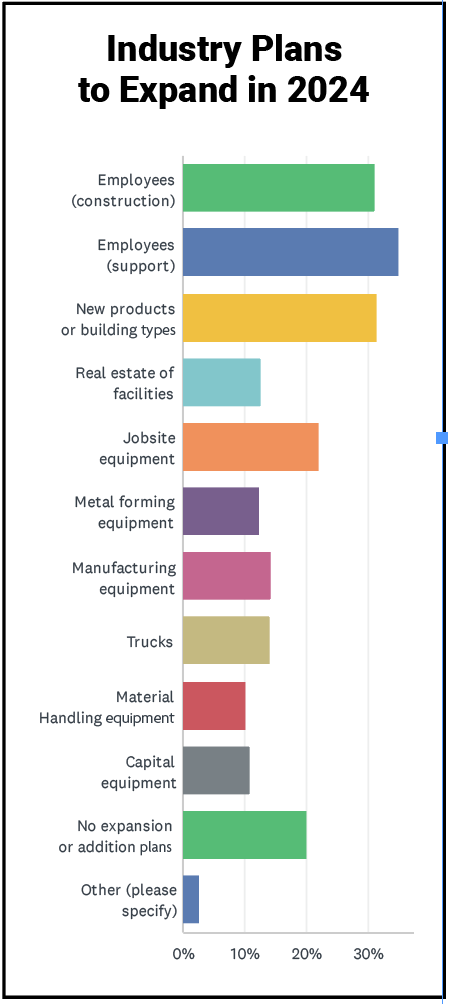

Check out the “Industry Plans to Expand in 2024” Table and you can see that only 20% of companies surveyed had no plans to expand in any way.

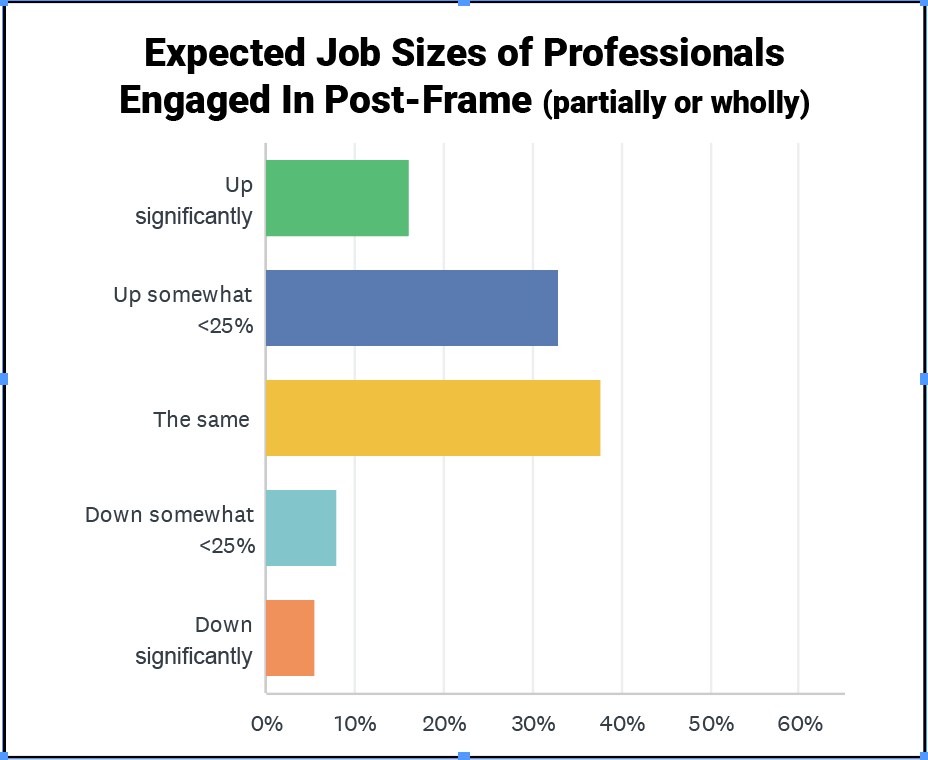

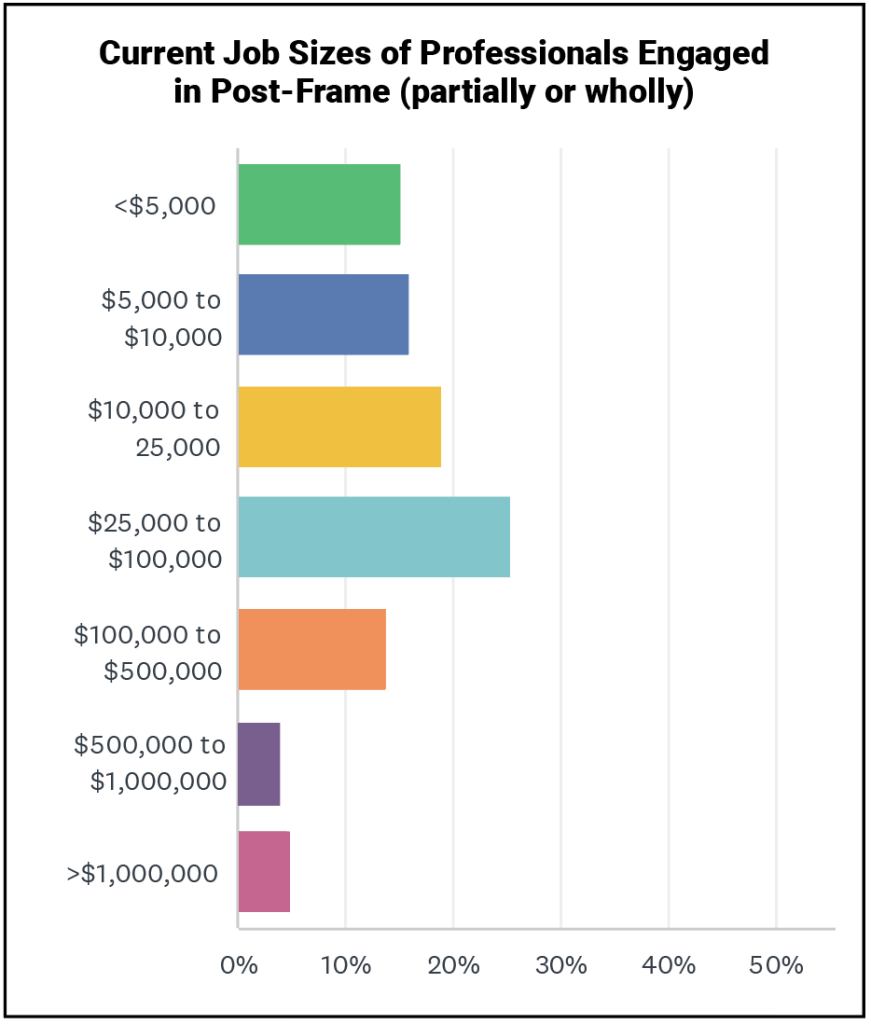

Basu predicted more opportunity in larger jobs this year and some insiders echo that belief. Our survey showed that many post-frame insiders expect their job sizes to increase

Industry Insiders Insights On 2023 and Expectations for 2024

Perma-Column had a great year President Mark Stover said. “All sectors are strong, especially agricultural. Interest rates have had an effect on barndos and on anything that requires a conventional mortgage. Otherwise, business is very good.”

Buddy Pullen, Regional Manager at Amerilux, said, “The agricultural market seems to be slowing a bit with several producers closing facilities citing higher costs and decreased demands.”

Paul Zimmerman, General Manager at Hixwood said, “We expect profitability to be better in 2024 than it was in 2023 because we are seeing higher demand for our products and raw material.”

Stephen Keith, National Sales Manager of Stockade Buildings, said that 2023 was a difficult year due to price increases (inflation) and material shortages with long lead times. He does not expect 2024 to be any different.

Stover sees improvement in material costs. “The material cost trend is steady with some variation up or down…not the wild swings we had a few years ago.

When it comes to challenges going forward, Allan Breidenbach, President of Wick Buildings, expects field labor to continue to be the biggest challenge in 2024 followed by material and supply chain management while controlling costs.

Stover said they had experienced challenges finding people, but they have managed to retain their new hires. “There is no secret formula to hiring and retaining employees,” he said. “It’s all about your ‘culture’ and paying a competitive wage in your local market.”

Zimmerman believes labor costs and interest rates will be the greatest challenges in 2024.

“Service centers and distribution aren’t as willing to stock as much inventory as was normal pre-pandemic,” Zimmerman said. “I believe this is due to the high cost of interest rates. This makes downstream manufacturers need to stock more,” he added.

Keith said, “Inflation will be a challenge for builders and suppliers. It has already delayed several projects as customers wait for lower prices.”

“I believe the worst of the inflation is behind us,” Zimmerman said. “The Fed is working diligently to keep it in check with moderate success.”

Eric Veliquette, President of Lakeside Fasteners said that inflation has been a challenge, but he believes it may begin to level out in 2024. He sees signs in the market that lead him to believe that prices may begin to decelerate.

“Demand for steel in Asia is decreasing. Decreasing demand in Asia usually brings US prices down due to excess products flooding the marketplace. Also, freight has come down; we are not seeing the spikes in price that we saw before. Of course, it could all change in a flash due to geopolitical circumstances,” he added.

As far as strong markets, Breidenbach said, “Residential remains in a state of flux. We are seeing far bigger projects with more sophisticated design requirements which leads to much larger project sizes.”

Veliquette believes that multi-family residential, commercial, and warehousing will be construction’s strongest markets. “Warehousing is required for computer storage facilities like Amazon and Facebook and AI storage needs,” he said. “Often these are pre-engineered buildings, like 4-5 football fields big.”

Breidenbach definitely expects good things for post-frame. “What a great time to be part of the post-frame community, he said. “Innovation in technology, manufacturing and increased customer awareness has opened new doors for all of us and I am excited to see what 2024 brings. FBN