By Linda Schmid

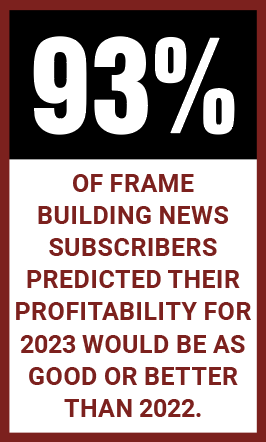

Hindsight is 20/20, but predicting what is coming can be tricky. Many industry and economic experts made predictions regarding construction activity in 2023, including many who said 2023 was going to be a letdown after the flurry of construction activity in 2022. Are those predictions coming true? What is the state of the industry now? Based on the first few quarters, what is indicated for the rest of the year? And what, if anything, can builders do to make themselves more economy-proof?

Current Strengths and Weaknesses

Stephen Keith, National Sales Manager at Stockade Buildings, says that business was surprisingly busy in the first quarter of the year. The second quarter saw a dip in the suburban buildings that are one of their staples, but there was no lack of garage and agricultural projects.

Paul Zimmerman, General Manager of Hixwood, said that the industry is strong. “Not as strong as 2021 but still strong,” he said. “Overall, the economy hasn’t affected this industry. We have seen a shift from recreational toybox type sheds to more agricultural buildings, but demand is still strong.”

Steel residential siding and steel board and batten siding have performed much better than expected, Zimmerman added.

Mike O’Hara, National Sales Manager at Levi’s Building Components, agreed that the state of the economy has had limited effect on pole barn building. He says that as a representative of a company that participates in “an interesting niche market that spans residential, commercial, ag, and shed, they really haven’t been negatively affected by the economy yet.”

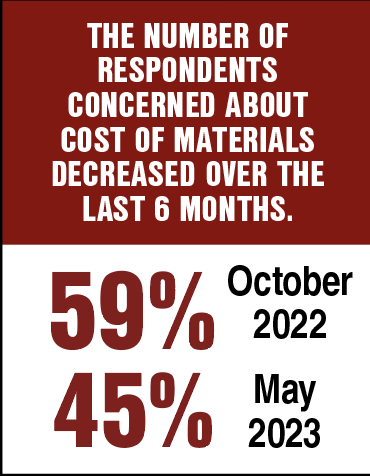

Even the metal and lumber pricing fluctuations haven’t negatively impacted projects, according to O’Hara.

Buddy Pullen, Regional Sales Manager at AmeriLux, finds that units and sales are down, but that is what most people expected as the pandemic ended and everything opened up again he stated.

Andrew Mullen of Direct Metals Inc. (DMI) said that they believe a general economy recession is underway.

“We have seen a slowdown in the 4th quarter 2022 and first quarter 2023 in new residential construction,” said Mullen. “This is mainly due to a pull-back by large national builders due to the cost of customers financing new homes.”

“Higher interest rates make the ‘repair or replace’ question much more important,” Pullen said, “and in the current condition, I feel like end users will focus more on home improvement and upgrading versus purchasing a new home.”

Ben Johnston, COO of Kapitus, a provider of financing for small and medium sized businesses said, “Higher interest rates are cooling the real estate market across the country, but we continue to see strong credit demand from contractors as a shortage of affordable housing, coupled with low unemployment rates, generate demand for new housing stock.”

He also sees homeowners who are locked into lower rate mortgages choosing to stay in their homes rather than selling and repurchasing in a higher rate market. These homeowners are looking to renovate existing housing stock, driving demand for contractors.

Since spring of 2022, Johnston has seen a tightening in credit, however, which accelerated after the failures of SVB and Signature Banks. As banks become more cautious, many quality applicants, often small businesses, are unable to obtain the financing they need.

Perhaps tighter credit explains why Sean Shields of the Structural Building Components Association (SBCA) sees that single-family housing construction has returned to 2019 (pre-COVID) levels. He notes that many component manufacturers who were in a position to pivot to multi-family projects actually saw an increase early this year as near-record numbers of large projects got underway.

High-end earners who will sometimes move forward with projects regardless of the economic situation have continued to invest in real estate and home improvement.

For many, the slow start to the year is providing the opportunity to retool and retrain.

“Production equipment that has been on backorder for 12 months or more is being delivered and installed,” Shields explained. “Personnel have to be trained on these new systems, and the current conditions are favorable to getting this new capacity up and running.”

Due to the current slowdown, lumber costs have been relatively low for most grades and sizes. MSR lumber is still difficult to source in many areas of the country, though, impacting products such as floor trusses and long span roof trusses.

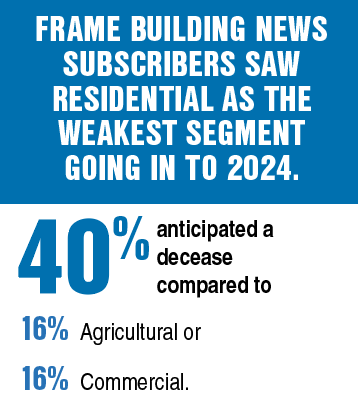

However, it appears that not all construction niches are equal. Rob Haddock, CEO of S-5!, says that while residential construction has taken a geographically varied hit, other sectors are doing well.

“The commercial/industrial space is still reasonably robust, especially in manufacturing and data center related construction. The agricultural marketplace is on stable ground, pardon the pun,” Haddock said.

“Obviously, the economy has dampened real property commerce because of interest rate increases, but the uncertainty of economic stability going forward has played the greatest role in dampening the construction economy,” Haddock said.

Keith Dietzen, CEO of Keymark, said that it’s a bit of a surprise how strong the post frame and roofing industries have remained while interest rates have gone from near zero to the highest in many years.

While interest rates are an important indicator of the economy and where it is headed, there are other indicators. Mullen states that the team at DMI believe that the national unemployment rate is a leading indicator of the economy, which is something they will be watching to help them make business decisions.

Ann Iten, Director of Marketing at Westlake Royal Roofing Solutions said, “We are continuing to watch any, and all, changes in the following areas: the industry’s ongoing challenges with labor shortages, residual global supply chain and logistics issues.”

The Forecast

Pullen predicts that the cost of borrowing money (interest rates) is going to be the biggest challenge for builders and contractors in 2023.

Keith says that Wichita is a diverse economy with suburban, commercial, and industrial opportunities which makes it strong even during recessions. However, he warns, “if the banks make it hard to borrow money, it will be 2008 all over again.”

Tom Bowne, Chief Economist for the Freedonia Group (a division of MarketResearch.com, Inc.) has this to say, “We expect that residential construction activity will face a number of headwinds in 2023. As the Federal Reserve maintains its tighter monetary policy in an effort to keep expectations of future inflation from rising, mortgage interest rates will remain elevated, constraining housing demand. Smaller regional banks are likely to be less eager to make construction loans while these banks’ balance sheets are under increased scrutiny. That tighter lending environment will weigh on builders’ and contractors’ ability to finance projects.”

Later in the year, however, there is a chance that the Federal Reserve may ease monetary policy somewhat, offering some relief for mortgage lending Bowne said. The other factor that will likely provide a boost to new construction as 2023 progresses, he continued, is the aforementioned lock-in effect of existing homeowners with low mortgage interest rates retaining ownership. The lack of available houses will create new home construction demands for newly formed households.

Mullen said, “As the financing industry and their customers get used to more normal or higher than 2020 interest rates, we expect the high demand for residential housing to continue to drive demand beyond the fourth quarter of 2023.”

The presidential election will have a bearing on the economy, according to Pullen, which translates to the construction industry in the following way: “With an election cycle around the corner, I expect a drop in interest rates next year which will bump volume,” Pullen said. “As far as the remainder of ’23, I am expecting a sustained trend of slowing volume while end users wait on that interest rate drop.”

Shields says that component manufacturers as a group expect the last half of 2023 to pick up. There is concern that many projects will be started within the same time frames, thereby straining supply chains and causing volatility in the lumber and steel markets. Further, hiring and training enough people to service a spike in demand could be problematic.

Component manufacturers advise builders and developers to avoid a “wait and see” attitude, according to Shields. “By the time you realize that a lot of projects are going forward, it’s likely too late to get a good place in line, which can lead to many delays such as material or production capacity shortages.”

Zimmerman believes that finding qualified labor will be the biggest challenge throughout 2023. He sees evidence that commercial building would pick up if there were more qualified crews.

Dietzen agrees that the labor shortage will continue to be problematic. He advises employers to automate as much as they can.

“My best advice to contractors is to automate,” Dietzen stated. “One of the most effective ways to address the labor challenge is to use software systems that can automatically generate necessary information that otherwise would require many hours of toil from team members who are already more than busy.”

These concerns may be inapplicable, at least in the short term, as Johnston warns that the SVB and Signature Bank failures have made everyone more cautious and if interest rates continue to rise, participation by those paying the bills may dissipate. More likely they will continue to build and invest, but they will be looking for price concessions and better overall terms Johnston said.

Johnston’s group sees trouble ahead for the commercial market as remote work becomes a permanent fixture in American life and many long-term leases expire.

Bowne feels the outcome of that trend is uncertain. He put it this way: “Office construction is expected to see below-average activity for a few more years as businesses continue to sort out staffing arrangements (in-person vs. hybrid) and their need for space to handle their personnel.”

He expects that the non-residential construction markets in general may face a bit of a downturn similar to the residential market later this year based on the difficulty in obtaining construction financing.

“Activity in retail building construction will be dampened if consumer confidence and overall economic activity weaken during the middle part of 2023,” Bowne said. ”

However, he did offer some hope for light manufacturing. “Construction of light manufacturing facilities will continue to be aided by efforts to improve supply chains, which could induce some reshoring of manufacturing activity,” he concluded.

Advice For Building a Stronger Business

What should companies do to improve or maintain their success going forward?

O’Hara advises partnering with suppliers to work together for better outcomes. They can offer such insight as when it is best to buy the supplies you need.

Pullen thinks that favorable financing options for customers will help, but he also advises that companies “minimize expenses, get lean, and protect cash flow.”

Mullen expects growth even if the economy is not roaring, mainly through new market penetration and the expansion of their product line. Perhaps there are new markets or add-on products or services that would bolster builders’ businesses.

Agricultural building is often touted as a safe market, and Mullen points out that the population is constantly increasing along with the need for domestic food production, so they expect agricultural building to increase in 2023. Perhaps this would be a good time to add agricultural building to the “menu.”

Renee Ramey, Executive Director of the Metal Roofing Alliance, comments, “We anticipate the importance of environmentally friendly building materials will continue to drive the market toward products that are sustainable, offer longevity, and provide benefits in the extreme weather conditions we continue to see happening throughout the U.S. and Canada.”

Pullen chimes in, “as the industry and our society trends to greener and more environmentally friendly methods and materials, manufacturers who do not share that view will be left behind.”

Increased interest in energy efficiency makes a good case for Haddock’s advice. He says builder/contractors should be proactive and provide themselves a Plan B in case their usual revenue takes a dip, for example the installation of solar photovoltaic products.

Two trends that Dietzen has observed seem to bode well for the future: more and more roofing contractors are adding metal roofing to their service menu and consumer demand for barndominiums is growing. “There is real opportunity in these markets,” Dietzen said. Perhaps they are more good Plan B options.

With some materials’ price fluctuations making estimation difficult, O’Hara had this to say, “Don’t just bid on projects to keep your crew busy. Know your numbers and take the emotion out of the estimating process. Then be all-in on projects as the best advertising is word of mouth and repeat customers.” FBN