Survey results provide a glimpse into how 2020 affected the post-frame industry, as well as how 2021 is shaping up

By the time you have this issue in your hands, hopefully the chaos following the presidential election has cleared up a bit. There might not have been a quick, decisive win one way or the other, but at some point, possibly even through legal means, the new president of the United States will be declared.

The importance of election results, along with general economic recovery, were part of the concerns expressed by participants of a State of the Industry survey we conducted in November and December 2020. Titled “Post-Frame Professionals: What’s Your Business Outlook on 2021?” we share the results of the survey below.

Before we continue, we’d like to share some simple demographics for those who completed the survey. Of our respondents, all are closely involved in the post-frame industry as a contractor; subcontractor; material manufacturer or dealer; architect, engineer, or consultant. Around 20% classified their involvement as a General Contractor, another 25% as a Building Materials Manufacturer, and another 20% as an Architect, Engineer, Consultant, and more. The remaining 35% was split among the few remaining options.

We would also like to thank everyone who took the survey. As we continue into the new year, we openly invite you to participate in our surveys so we can provide additional insight into the industry based on your feedback. We do so in order to provide the best information we can about the post-frame industry so it can continue to grow and expand.

And now, the results:

What type of construction is your primary business?

Agricultural 17.95%

Residential. 51.28%

Commercial. 23.08%

Other. 7.69%

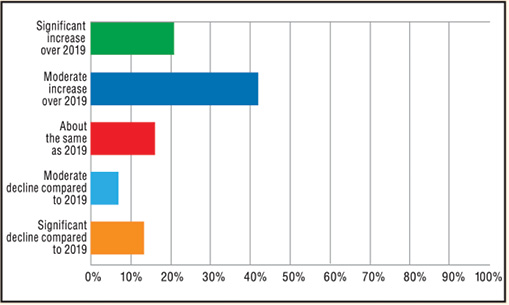

What do you expect your firm’s final contract volume to be at the end of 2020 compared to 2019?

Significant increase over 2019. 25.64%

Moderate increase over 2019. 41.03%

About the same as 2019. 17.95%

Moderate decline compared to 2019. 5.13%

Significant decline compared to 2019. 10.26%

How much work is currently in your pipeline?

We have contracts that will keep us busy throughout 2021. 8.11%

We have contracts that will keep us busy for the next six months. 37.84%

We are going project to project, but we’re optimistic. 45.95%

We are not busy at all and it does not look good for the future 8.11%

What happened to your volume of residential business in 2020?

Increased. 52.63%

Decreased. 15.79%

Stayed the same. 31.58%

What happened to your volume of commercial business in 2020?

Increased. 46.15%

Decreased. 23.08%

Stayed the same. 30.77%

What happened to your volume of agricultural business in 2020?

Increased 35.14%

Decreased 35.14%

Stayed the same. 29.73%

Was there a significant change to any type of construction other than residential, commercial, or agricultural that was noteworthy in 2020?

Yes. 12.82%

No. 84.62%

Do you have any expansion plans?

We are planning to expand our products/services in 2021. 33.33%

We are planning to add more crews and tradespeople in 2021. 23.08%

We are planning to add equipment to improve our efficiency in 2021. 20.51%

We are not planning to expand or add crews in 2021. 38.46%

Do you have any problems finding or keeping good help?

We do not have any problems finding good help. 7.69%

We do have problems finding good help. 76.92%

We rarely look for new help, so it is not a concern. 15.38%

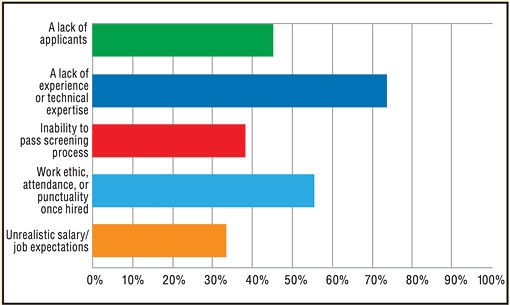

If you have problems finding or keeping help, is your problem (could select more than one):

A lack of applicants. 43.75%

A lack of experience or technical expertise in the applicants received. 75.00%

Inability of applicants to pass screening process. 34.38%

Work ethic, attendance, or punctuality once hired. 53.13%

Unrealistic salary or job expectations. 40.63%

Which had the largest impact on your business in 2020?

COVID-19 regulations and shutdowns. 47.37%

COVID-19 staff and employee health issues. 8.42%

Presidential election uncertainty. 26.32%

Violence in metropolitan areas. 0.00%

Other (collection issues and labor/material shortages). 7.89%

Did COVID-19 impact your business?

No perceptible impact. 23.08%

Yes, for a couple weeks then it returned to normal. 35.90%

Yes, there have been ongoing, major disruptions. 38.46%

Our business closed and remains closed. 2.56%

COVID-19 financial assistance:

We applied for a Paycheck Protection Program (PPP) loan, EIDL loan, or other federal program to help meet expenses during COVID-19 39.47%

We did not apply for any federal programs but did rely on other funding or financing to meet our expenses during COVID-19. 10.53%

We did not need a loan or other financial assistance 50.00%

Equipment and building supply acquisition in 2021 (could select more than one), we are looking to purchase or find:

A new truck(s) or vehicle(s). 41.18%

Post setting equipment. 2.94%

Work site tools and equipment. 17.65%

Building design software 17.65%

Roll-forming or metal-forming equipment 17.65%

New sources of lumber, posts, or columns 20.59%

New sources of doors or windows 17.65%

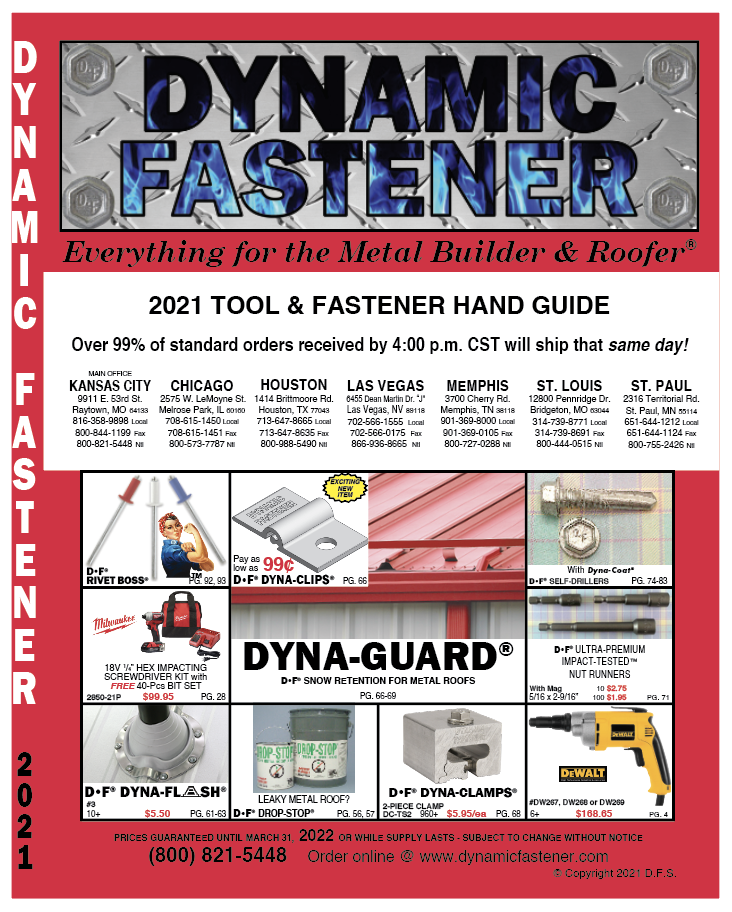

New sources of nails, screws, or fasteners 8.82%

New sources of foundation products or footers 8.82%

New sources of metal panels 14.71%

New sources of ventilation or moisture control products 14.71%

New sources of insulation products 20.59%

We are not planning on purchasing any equipment or changing suppliers in 2021 32.35%

We are looking for a new source for a type of product or equipment not listed above 5.88%

Priority of Concerns

The survey included a section where respondents could select, on sliding scales, the weight of importance they gave to certain current events and issues. They are listed below in the order of importance they were given in the results:

#1: Supply chain issues

#2: General economic recovery

#3: Raw material costs

#4: The presidential election

#5: Government regulations and zoning

#6: Freight and delivery prices

#7 (tie): Labor and payroll expenses

#7 (tie): Mandated restrictions from the COVID-19 pandemic

#8: COVID-19 health issues

What other concerns will impact your success in 2021?

Our post-frame survey provided an area for feedback on critical areas of concern. Respondents could write in their opinions regarding what concerned them the most. Again, the election had many direct references, with employee issues and the general economy high on the list. Below are some of the individual responses we received, in no particular order.

• Labor shortages and weak unions

• Supply chain issues and shipping problems

• Availability and cost of materials

• Taxes and government regulations

• Pandemic restrictions and health issues

• Trends toward a recession

• Keeping ethical business practices compared to competition

As seen throughout the survey, supply chain issues and raw material costs are problems that don’t appear to be going away anytime soon. We briefly covered the lumber shortage in the November 2020 issue of Frame Building News, which led to a handful of reader responses. One reader pointed out that tariffs and subsidies are not only affecting the availability of lumber, but also other important goods. He aptly put it: “…lumber tariffs are not the only problem. Everywhere one looks, he can find the results of subsidies in many forms.” FN