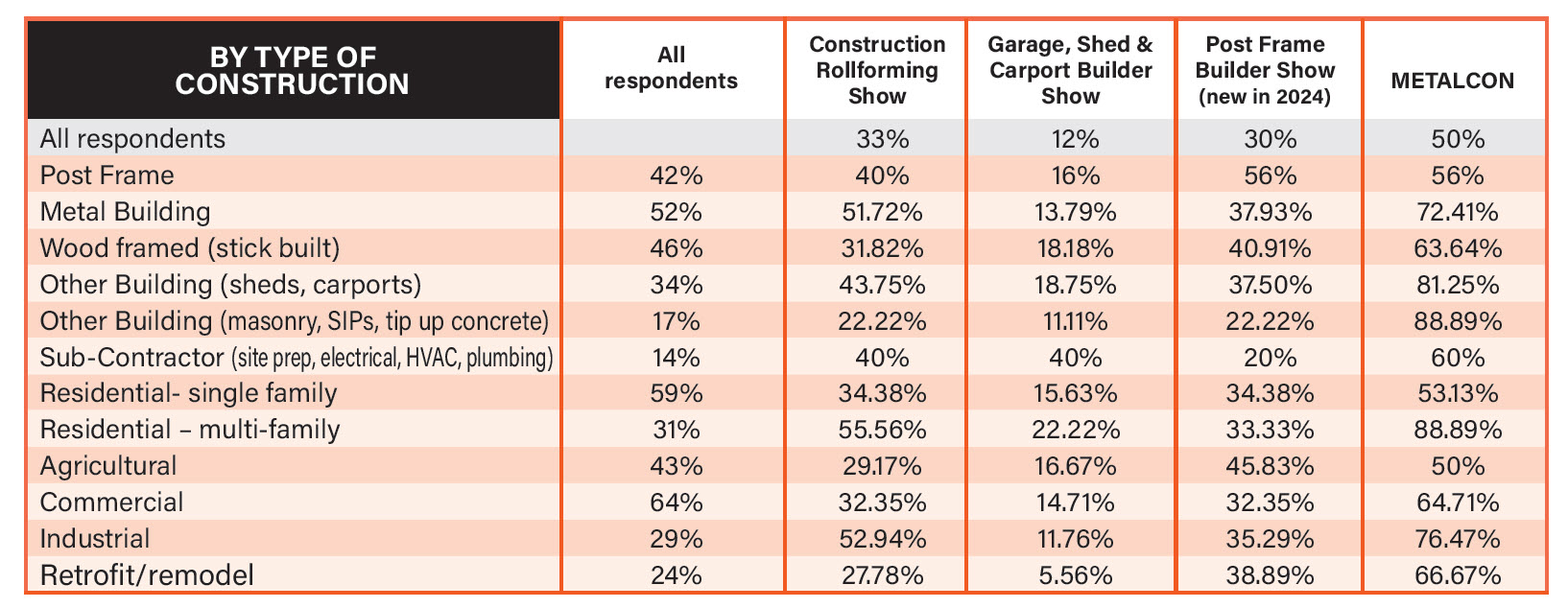

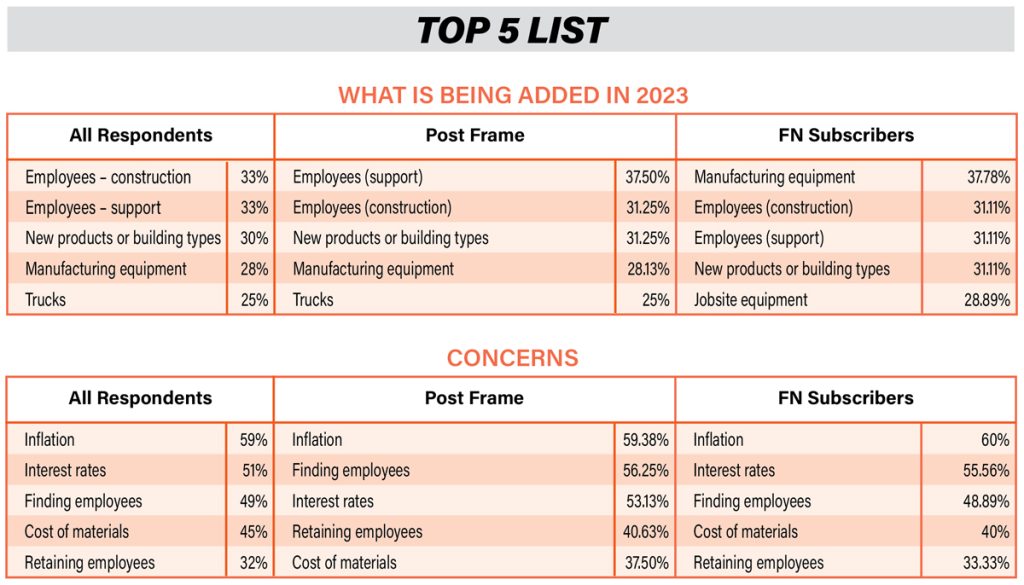

Our Mid-Year Survey included questions about concerns and challenges for the remainder of 2023. Some things remained constant across “All Respondents,” “Post-Frame Builders,” and “Frame Building News Subscribers,” but there were some interesting differences.

All groups listed four of the top five things being added in 2023 as the same. All were planning to add Support Employees, Construction Employees Manufacturing Equipment, and New Products or Building Types. The really good news is that roughly 1/3 of respondents in all categories were looking at adding. One third of respondents adding people and new products is a good sign that post frame is healthy.

The one difference was All Respondents and Post-Frame Builders (PFB) were looking at adding Trucks for the last spot and Frame Building News Subscribers (FN) were adding Jobsite Tools; 25% of PFB and 22% of FN were looking to add Trucks, and 22% of PFB and 29% of FN were looking to add Jobsite tools.

Some nuggets for PFB vs. FN that didn’t make the top five. A total of 22% of both are looking at adding Metal Forming Equipment; 9% of PFB and 11% of FN were buying Real Estate.

For concerns, the most remarkable aspect was the similarity across groups. Number one across the board was inflation. Numbers two and three were either Interest rates or Finding Employees. Numbers four and five were either Cost of Materials or Retaining Employees.

With Inflation being number one and Interest Rates either two or three, the economy is obviously the biggest concern.

Other survey questions help tell a more complete story: 37% of PFB and 45% of FN predict their profitability will increase in Q3 and Q4, while 69% of PFB and 64% of FN believe the General Business Climate will stay the same or improve. In spite of very consistent and high levels of concern regarding inflation and interest rates, the outlook for the future of post frame for Q3 and Q4 is pretty optimistic. FBN